“Money makes money. And the money that money makes, makes money.” –Benjamin Franklin

This quote from Benjamin Franklin illustrates the power of compound interest – interest that generates further interest. It is a proven way to generate passive income, and a savvy investor’s best friend.

Compound interest becomes particularly potent when applied long-term. Interest accrues exponentially, which means the longer it collects, the more it earns.

We typically think of compound interest in terms of saving, but the same concept can be applied to some investments. American Homeowner Preservation, for example, allows investors to automatically re-invest returns, which results in compounding. We decided to take a look at what someone would earn with our model if they invested $100 per month every month for one year, five years, ten years, and so on.

Investing is not like opening a savings account – returns do not work exactly like interest. Investing is inherently risky, and neither AHP nor any other company can guarantee that future performance will equal past results.

But as a fun experiment, we decided to project compounded returns based upon the rate our current fund, 2015A+, has historically returned to investors, 12%. Since AHP pays out distributions every month, returns can be re-invested and promptly compound.

If you made your first $100 monthly investment on January 1st, then come February 10th (distribution day!) your account will be worth $201 (because you invested an additional $100 on February 1st!)

Come March 10th, your distribution will have more than doubled – because you are now collecting returns on $200 in investments, and $1 in returns. Your account will be worth $303.01.

Keep this going all year, and at the end of your first year, your account would be worth $1,280.93. That’s nearly $81 in returns – solid, passive income.

Another year, and you’re up to $2,724.32. You have earned over $300 – just for investing $100 a month in American Homeowner Preservation.

This is a long-term strategy, so let’s keep pushing it. Maybe you’re investing to have money to retire on in 30 years, or maybe it’s for a big purchase. Either way, you’re in this for the long haul.

After 5 years, your account would be worth $8,248.64. Over $2,200 of that is earnings. The term of your investment with AHP will also have ended, as we intend to return all investor capital by the end of five years.

Congratulations! Think of what you can do with that money.

A down payment on a new car, perhaps? If you wanted to purchase a new car and pay the standard 20% down payment, then you would be capable of purchasing a $40,000 car! If that isn’t your style, $8,200 is enough to pay tuition at many community colleges, or pay down old debts.

$8,200 is also enough for a down payment on some homes, depending on your credit. Typically, down payments on houses range from 5%-10%, giving you some leeway in your home buying options.

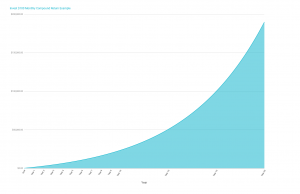

And of course, there is always the option to invest again. American Homeowner Preservation will likely still be purchasing mortgages and helping families avoid foreclosure, so you could take your money and start the process all over again. Peruse our handy graph to show you what your returns would look like up to 25 years later (if you keep investing $100 a month, of course).

Investing, re-investing, and compounding your returns is a solid long-term strategy for building wealth. With a minimum investment of just $100 and the option to schedule recurring monthly investments, AHP welcomes you to put our thesis to a real-life test.

440 S LaSalle Street, Suite 1110, Chicago,IL 60605

440 S LaSalle Street, Suite 1110, Chicago,IL 60605