Sharon and her husband have been in their home for more than ten years, and for the past several years they have been stuck in the whirlwind process of trying to obtain a mortgage modification. The downward spiral of the economy caused Sharon and her husband to fall behind on their payments, and after spinning their wheels with different lenders, they feared they would lose their home.

“We made it very clear that my husband is self employed and that the past couple of years, the economy certainly had a direct result on income coming in,” Sharon said. “We were down to one income which was mine…but that was the original reason we got behind.”

Sharon and her husband had been working with the original lender for about a year when they were denied a loan modification. They appealed the decision, but during that process their loan was sold to another lender. They began the process of applying for another modification when their loan was sold yet again. “It changed hands so many times it was making our heads spin.” Sharon said.

Sharon described the process of having to work with new lenders to be painful and stressful. She never lost contact with any of her lenders and actually called them on a weekly basis, keeping notes of the dates and times she spoke with them.

When Sharon and her husband received a letter in the mail from AHP, they did not believe the offers that were presented to them. They had heard stories about predatory lending and companies who did not have their best interests in mind, so they called AHP’s founder Jorge Newbery. “We both asked a lot of questions and he told me to go on the website, but we were very hesitant. It just kind of sounded too good to be true.”

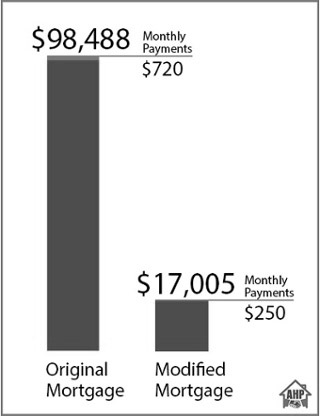

After researching online and speaking with Jorge, Sharon and her husband decided they could trust in these offers. For $2,000 AHP was able to settle all delinquent interests and charges on the loan and cut the payoff amount from $98,488.73 to $17,005 while reducing monthly payments from $720.65 to $250.

The modification was not quite the light at the end of the tunnel for Sharon and her husband because, in addition to their mortgage, their property taxes have also been sold to other companies. They are still in the process of catching up on the property taxes, but are happy that they were able to take advantage of AHP’s offers and hope others do as well. “I would absolutely recommend you all to somebody else; I mean people don’t want to lose their homes.”

440 S LaSalle Street, Suite 1110, Chicago,IL 60605

440 S LaSalle Street, Suite 1110, Chicago,IL 60605